Best Budgeting Apps in Android and iOS to follow in 2021 and Beyond

The apt budgeting apps can make a massive difference in the financial maintenance of your personal life. A hand-made budget is not an avoidable option, but using an application for enduring every financial step is a wise choice. Moreover, everyone wants to try to manage their budget to save as much as possible for the rough phases. There is no fixed budget plan for everyone, but one can adopt the plan that fits in a glove for all needs, wants, savings, and debts.

[toc]

The 2020 year has brought many commuting rules of personal financial management for almost all the sectors. Additionally, the past year’s pandemic has spun up the spending ways and saving routine. People have changed their spending proportions, focusing more on saving a significant amount at the end of the month. Digital ways of managing personalized capital were triggered in this situation. The budgeting source manages the budget development and following more efficiently.

Image: (Source)

There are a lot many options to take from a budget managing software. Consequential software selection is where the rubber hits the road. Using an apps to manage personal money is a smart way to prevent the cliff from falling. The market is divergent in money managing software; this blog will drive to the conclusion of picking up the finest of all.

How to Choose The Top Personal Budgeting Apps?

While filtering out the eminent finance supervising app, it seems to be a bit of a small decision; but it is not. Variants are providing similar benefits with some alluring plug-ins and usage. However, the one that suits you depends on what you expect from that software. Here are a few of the general characteristics to examine before you commit to budget software.

Secure Process

Budget apps must be secure, as the details entered on these apps are extremely important. When the money comes in any picture, security comes in the frontline. Ensure the app you choose has multi-factor authentications and more robust encryption. The features dissuade any intruder from accessing any personal data on the website.

Software Costing

While picking up the financial apps, scrutinize both paid and unpaid apps. Slant towards the free apps might keep you unaware of a good financial outlook provided by paid options. There would be some software that will be worth investing in as it can improve your financial stats. Consider both free-of-cost apps and paid apps for selecting the finance management apps.

Features

A feature is a place where various apps differ, which makes them unique. A money management app must have some general specifications: continuing all money accounts, notifying for the deadlines of subscriptions, drafting financial strategies, credit score tracking, mark spending, setting goals, and other similar. It depends on how you crack the code.

Responsiveness to the Users

No software is ideal. Budget managing apps have a technical staff to respond to all the problems of the users. While you pick one budget apps, look into what customer services it provides. The obtaining of budgeting software in Android or iOS both seek instant responsiveness and several options for customer service, even if you operate in any of the devices like laptops, mobile phones, or desktops.

Consider the Prominent Budgeting Apps for Android and iOS

Enormous options are present in the market that give fluent use for maintaining money flow. Here, we will outline the top 10 budget apps for Android phones and Apple phones. One of the remarkable benefits of those applications is that it is operated anywhere, draws all the money related comparisons.

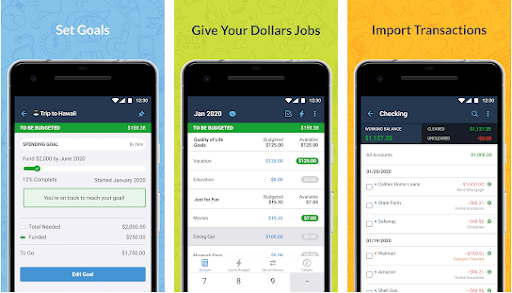

You Need A Budget

YNAB (You need a budget) relies on the income of the previous salary check. The software swaddles the income and then plans it to spend on each need. It processes the money, keeping every dollar of the income focusses on spending. Besides, this app caters to all the future insights of spending ways. Also, it concludes with the stats and charts that enable progress examining.

YNAB is a popular choice for the way it works and governs the income. As you receive the amount for the month, it makes every decision to spend the money on. This app ensures that, on average, one can save up to 600 dollars in two months and for like $6000 in the initial year. It works around the four basic rules of YNAB –

- Allocate each dollar a work

- Clutch the needed expenses

- Adapt oneself to adverse circumstances.

- Age you money

Image: (Source)

Boons and Banes of YNAB

Boons:

- 34 days of a free trial

- It teaches budgeting rather than automating the processes

- Switch easily between multiple budgets

Banes:

- It is time-consuming

- No bill tracking features

- No investment tracking

YNAB is compatible with Android, iOS, and desktops. The cost could be a significant barrier for a few of the applications consumers. However, a cost-free trial enables the users to decide the worth sparing on it.

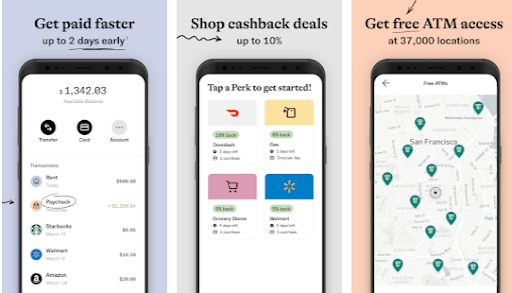

Empower

Empower is another way of budgeting, which also accumulates savings. It merges all the accounts to oblige a decent cash flow. It comprises a remarkable feature called Autosave that allows the users to save money trouble-free. Users can set the goals from the app, and the app will transfer the extra money into savings.

Moreover, when the users deposit their paycheck, they can access it in advance. They can acquire Cash Advances of around $250. There will not be any charges and fines for that. The amount would be balanced with the next paycheck. It even allows cash backs of up to 10% while using the card of Empower that yields profits.

Image: (Source)

Boons and Banes of Empower

Boons:

- Can keep tracing of a crypto wallet

- Can make payments of debts

- Allow the easy installation and use

Banes:

Empower is found in both the Play Store and Apple Store. In all, Empower will aggregate all the money flow from various accounts and will save for you.

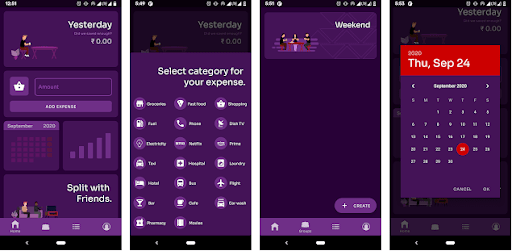

Goodbudget

Goodbudget is a recommended app for managing the personal budget. It clasps traditional envelope budgeting methods to a virtual space, automating financial management. It allows consumers to trace all bank transactions and carry out charts to analyze the spendings. The software works to perform every task smoothly by syncing them, further making it a seamless app.

Goodbudget offers an all-time free plan. It has limited access and works on the conditions. However, it also has paid plans with extended support. It takes $7 per month and $70 for annual subscriptions. Unlike the free subscription, it has endless envelopes and accounts, accessibility in 5 devices, and email support for customer service.

Image: (Source)

Boons and bane of Goodbudget

Boons:

- Transfer money between the envelopes

- Explainable charts and stats

- Proper sync on multi-devices

Banes:

- Limited free version

- No investment tracking

- Manual logging bank accounts

The availability of the app is on both- Android and iOS. Goodbudget is a significant option for the shared account management. It permits to plan a budget and that could be shared with all the connected ones.

Mint

Mint is the demanding app in 2021 for governing personal finance. It is the best and oldest app for freshers, producing trouble-free software. It categorizes the spendings to keep a complete trace of capital. The app traces the invoices and also gives credit scores accordingly. Plus, it caters to balance the user’s budget plan with the national averages.

Mint is a free app for budget planning. It syncs the money accounts with banks and allows the real-time tracking of paychecks and expenditures. Further, it has a secure sign-in option. App has enormous features, which makes it simple to mark the net worth and progress goals. Alerts on crossing the budget lines and maintaining cash flow, making Mint the best option for budgeting.

Image: (Source)

Boons and banes of Mint

Boons:

- Real-time reports of expenses

- Collate with spending trends

- Free of use

Banes:

- Contains Ads

- Issue while Syncing the accounts

- Arising of technical problems

It allows managing the budget on any device like Android, iOS, and even PC. The app makes the monthly earnings, and quick to trace and analyze, making financial life more straightforward and affordable. The app encourages the users to save more by creating saving goals and showing detailed information about the monthly money flow picture. But if you are an investor and have to deal with multiple currencies, it would be great to look for Mint alternatives because this one limitation can stop you from knowing accurate results.

Wally

Wally is a genuine app that eliminates unwanted pop-ups. It has a superficial establishment of application design. The app is simple to use and engaging as it has an attractive interface. It is not the most convenient app to use but provides the best features of budgeting. The traces the input and spendings while providing the snapshots of the savings resulting in resisting the overspendings.

A worthwhile characteristic of Wally is that it supports multi-currencies in the software. For a migrant or a digital wanderer, it is the best app to manage personal funds. Additionally, it saves all images related to essential spending and business-related things.

Image: (Source)

Boons and Banes of Wally

Boons:

- Easy to use features

- Pleasant interface and graphics

- Access multi currencies

Banes:

- No remarkable feature other than the budget for personal money management

- Additional feature setup

Wally offers a cost-free trial to use the budgeting app before buying subscriptions. It renders a package of up to $24.99 per year. App installation costs zero. Plus, it is supported in both Android and Apple mobile phones.

Frequently asked Questions

Which are the Significant Apps For iOS and Android individually?

For iOS

- YNAB

- Mint

For Android

- Wally

- Good Budget

- Empower

Which are the secure apps for budgeting?

One of the intense concerns of using a budgeting application is the maximum-security software provided. According to Forbes, enlisted resources are the most secure budgeting apps to look after monthly expenditures used in Android and iOS.

- YNAB

- Goodbudget

- Mint

Is it worth it to give away for managing an individual’s banknotes?

The finance managing apps for personal funds are safe to use. They manage all the expenses resulting in overall savings before the time of the next payroll. They contribute to making your capital management easier with just a few taps. Moreover, it gives away statistics and results to examine your daily spendings. Some of the applications also contain characteristics that automate the process of budgeting.

Some of the applications are cost-free. However, avoiding the paid option can keep you unaware of the best interfaces to give the best results.

Conclusion

To maintain your money flow, there are numerous budgeting apps on Android and iOS. You can hand-pick based on your needs. These apps support propelling your money in the right direction tracing every dollar of your revenues. When you can lead your capitals, you can oversee your life easily. The prominent ones are derived here, yet a lot of choices are there to pick from.