Income Report- Stepwise Guide to Know Where Your Business Stands

The income report is a summary of profit and loss and expenses made by the businesses. Most businesses prepare three different types of income reports helping them to calculate ROI, expenses, and other things efficiently. The balance sheet helps brands briefly understand their business’s cash flow and plan their strategy accordingly.

[toc]

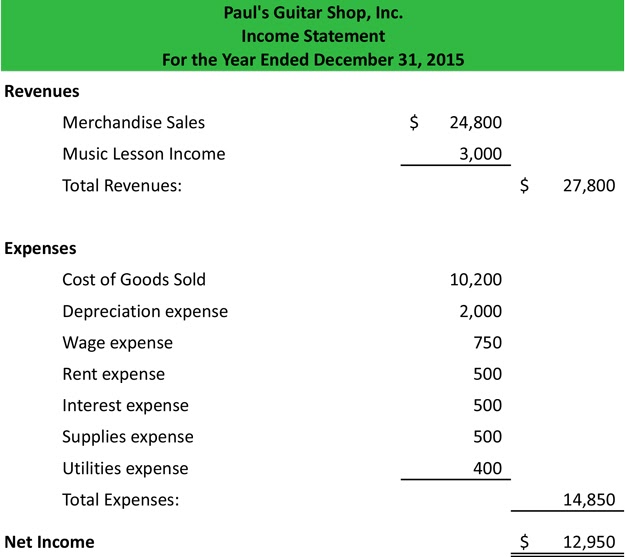

The report helps brands to check the profitability of their firm over time. They can prepare the report based on different criteria; they can choose to prepare it as per time frame, including month, quarter, year, annual report, etc. The below example shows how businesses prepare simple income statements to have quick over their profit and loss.

Image: (Source)

What is an Income Statement?

An income report is a crucial component representing the financial condition of any brand. It helps brands to know whether their organization is making a profit or loss during the period. Many other terms are used to define it; it includes profit and loss statements, income statements, and much more. A few of the essential points that must be considered while preparing the statement include:

- Identifying revenue and other charges;

- Need to show expenses as per their classifications;

- No requirement for different sheets to represent functional and nature-based classifications;

- Disclosures of tax, profit, and loss after tax payment;

- A declaration of primary EPS is needed.

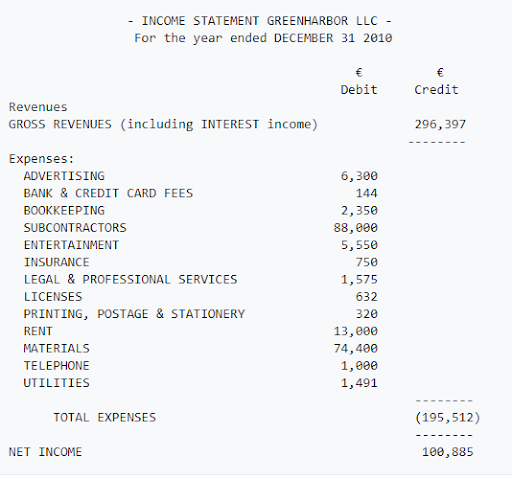

Sample of Income Statement:

Image: (Source)

Why is an Income Report Crucial for Your Business?

Most businesses these days choose to prepare their profit and loss statement digitally; they prefer to use advanced software and budgeting apps to measure all expenses, profit, and loss related to their business during the specified time interval.

The income statement makes it easier for brands to know the financial condition and progress during the time. The report information includes gross profit, cost of assets sold, trading charges, management costs, and much more.

Small businesses can use a different account and budgeting software like:

Enterprises need to prepare an income report to identify whether they’re making a profit or loss? And what is the main reason behind the ups and downs you face during your business? And to have an accurate income report, businesses need to maintain and manage every detail efficiently. There are numerous benefits of maintaining an error-free and accurate income statement, these includes:

- Helps to make a better decision;

- Ensure business success;

- It helps to make your business future-proof.

Profit and loss statement is crucial for businesses to prepare and maintain. Developing a systematic income statement can sound troublesome for most businesses, but it becomes easier to consider using digital tools and other platforms for their business. Entrepreneurs can even hire professionals to help them with the same task.

Steps You Must Know to Make an Income Report -Check Every Here!

No matter which size and type of business you own, it becomes crucial for you to maintain every report in a profit and loss statement format. It can help you to find expenses, ensuring to improve your business decision making and upbringing at the same time.

You can choose to prepare different statements like ledgers, balance sheets, and many more, helping you maintain and track each expense related to your organization accurately. However, you need to follow few essential steps to create an income report for your business, these includes:

Know the Report Period

Profit and loss report helps you measure revenues and expenses during the time interval; it can be prepared based on week, month, quarterly, or annually. Brands are allowed to pick any of the duration of their choice. You’re allowed to pick any of the duration to calculate the income and other expenses as well.

Entrepreneurs who are publicly operating their business need to focus on creating a profit and loss statement. Brands need to produce income records on a periodical basis to recognize business inclinations and estimate the financial results as well. It helps them to plan the strategy and work for the upbringing of the brand.

Generate Review Report

To generate a profit and loss statement for your organization, you must write out a standard balance sheet or ledger as per your requirement. You can use a cloud-based accounting tool to create a trial balance or other balance sheet. It is an internal record that lists the prevailing ledger for a particular reporting period. It will provide you all the limited balance characters you require to build a revenue record.

Calculate Your Expense

You can calculate your expense to be composed of the shortest labor, producing the above costs, and straight materials you acquired to build the traded inventory. The expense of goods exchanged for the period beneath your sales revenue.

For instance, if you trade with around 20,000 units of record and handle a dimension of $4 for every unit, you would report $80,000 for the cost of goods marketed. If you are a reseller, the cost of goods trade is likely the cost required to acquire the record.

Identify Every Cost

You need to decrease the tax from the tax income figure and subscribe to the price at the end of the record list. A change is introduced to income and other things as a revenue necessitate to be measured in the profit and loss statement.

Append Utility Expenses

The gathering of all expense lines details of operating cost in the ledger and balance cost includes selling, operating, and other costs. Insert the result into the profit and loss record; this can help you know your business’s gross margin and much more in a short time.

Ending Note!

Creating income records can help brands quickly glance over their profit-making and help them make a better decision for their company. To know the profit and loss statement in a better manner, you must have explicit knowledge of the preparation of the record.

The term simply revolves around preparing an income record; this includes tax cost, asserts cost, and much more. The income record of different businesses might appear different from each other in numerous senses. However, there are numerous formulas and techniques to calculate each cost, including tax, gross, etc. Once you get it all calculated, maintain everything in the income report you create for your business.